Cannabis Legalization By State: What You Need To Know

In our recently published Q1 Market Brief: Licensure and MSOs in the United States, Emerald Intel takes a deep dive into cannabis legalization by state and its impact on the collective cannabis industry.

As a sales or marketer looking to expand your product or services footprint in the cannabis marketplace, understanding state licensing models and legalization types by state are critically important to success. You may be asking yourself “how does this information help me? If I’m selling to licensed cannabis companies—as long as they have a license, isn’t that all that matters?”

Here are three reasons why understanding cannabis legalization by state should matter to you:

- Being an educated provider or supplier means something to buyers. Your prospects have choices, and the more you can relate to their challenges and situation, the better chance you have of becoming their first choice. Speaking your buyer’s language and referring to industry specifics they’re being impacted by demonstrates that you’ve done your homework and may be best positioned to help them after all.

- Your Ideal Customer Profile (ICP) may be defined by license model or type. If, for instance, your product or service is best positioned to support dispensaries, or cultivators growing for medical use only, understanding license types and the states that issue them matters a great deal. Identifying companies and contacts that meet your ICP ensures maximum time is spent on those most likely to buy. Need help defining your ICP? Read our blog about defining a cannabis ICP here.

- Knowledge of license types and status can speed up the research process. With access to a business intelligence tool like Emerald Intel, you can use license type, status, and even location (region, state, city, etc.) to narrow search results and conduct research more effectively. For example, if you see the most success selling your product or service to those with a pending adult-use license status, surfacing those prospects quickly can mean making an impression before your competitors. Read this blog for more research tips.

Cannabis Legalization By State

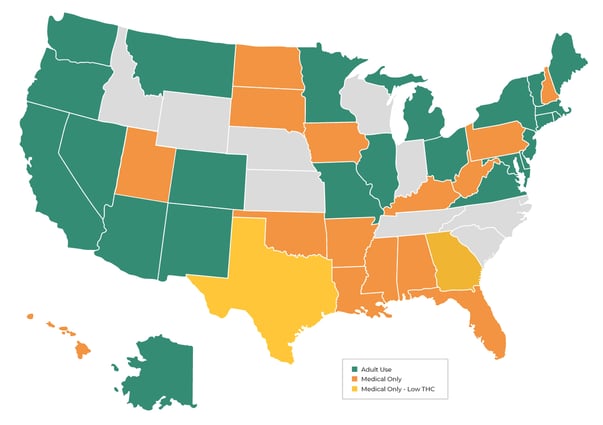

To-date, 42 states have legalized medical cannabis use over the last 20 years, and 24 states, along with Washington D.C., have legalized adult-use. From 2014 to 2019, 14 states legalized medical use, with another five states making the move to legalization between 2020-2023.

The infographic below shows cannabis legalization by state as it stands today:

New York (2021), New Jersey (2022), and Maryland (2023), have recently expanded from medical to adult-use. Delaware and Ohio are opening their adult-use application windows in Q2 2024 and Minnesota is well into its adult-use rule-making process with licensing expected to begin in early 2025.

Florida, Idaho, Nebraska, and South Dakota will put legalization questions before voters in the 2024 November election. While Nebraska and Idaho aim to break into the cannabis marketplace by legalizing medical use, Florida and South Dakota are looking to its voters to determine whether adult-use is next on the horizon.

There are seven additional states which do not require voter input to legalize cannabis but will be decided by state legislatures:

- New Hampshire | Legally medical since 2013, New Hampshire is entertaining a state-run cannabis sales model for adult use, which would be the first of its kind.

- Pennsylvania | Legally medical since 2016, many are for the flip to adult-use, and there’s a bipartisan bill in play, but political maneuvering may be required.

- North Carolina | A Senate-approved medical cannabis bill from 2023 is now up for review in the House. If approved, this would allow 10 companies to open its doors as vertically integrated operators.

- South Carolina | While a medical bill was initially passed in the Senate in 2022, it came up against roadblocks in the House. It has since been revived and may again grow legs.

- Kentucky | Decriminalized in 2023, Kentucky is a legally medical state but is sending its citizens to neighboring states for sales. They may be doing something similar this year if they legalize adult-use, with sales expected to begin in 2025. .

- Wisconsin | The current proposal would allow for independent businesses to cultivate and process medical cannabis with licensure and regulation.

- Hawaii | Legally medical since 2000, the Hawaii Senate approved an adult-use legalization bill in 2023, which has since been met with a revised draft bill.

Vertically Integrated States

Thorough knowledge of cannabis legalization by state also includes understanding the concept of vertical integration. In the cannabis industry, vertical integration is where a single company controls multiple stages of the supply chain, often referred to as “seed-to-sale”. Companies in this position will typically:

- Cultivate the cannabis plants

- Process and extract the cannabis into various forms (e.g., oils, concentrates)

- Manufacture cannabis products (e.g., edibles, topicals)

- Retail the products to consumers through dispensaries

Emerald Intel researched every state with 50% or more Multi-State Operator (MSO) market share and the majority of these states require vertical integration.

Why does this matter to you? Generally, multi-state operators (and some single state operators) are the only companies with deep enough pockets to afford the start-up costs necessary to be vertically integrated—which means in these states, you’re selling and marketing to much larger companies. This also means you may need to employ strategies to upset incumbent providers, which could result in longer sales cycles.

The following states require vertical integration today:

- Arizona

- Delaware

- Florida

- Minnesota

- New Hampshire

- Virginia

For more specifics on vertical integration and MSOs, download our Q1 Market Brief here.

While no doubt complex, maintaining a working knowledge of cannabis legalization by state will help you be a better sales or marketing professional. By knowing which states have legalized medical or adult-use, their license types, and associated rules, you create more effective messaging that will resonate with your ICP.

That said, you don’t need to be a walking encyclopedia of cannabis legalization by state, especially if you have a business intelligence tool like Emerald Intel! Emerald Intel has created a master license classification model to help sales and marketers filter through thousands of companies and contacts so they can focus on what they do best—generating pipeline and growing market share.

To put our data to the test, schedule time with us here.